By Staff

Wednesday, October 23, 2024 10:50 AM

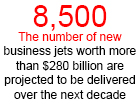

Business jets are in high demand according to the 33rd annual

Global Business Aviation Outlook recently published by Honeywell, a company that specializes in aerospace and building automation. New data shows that up to 8,500 new business jets worth more than $280 billion will be delivered over the next decade.

New business jet deliveries are expected to climb by 12 percent compared with 2024. Additionally, fleet additions remain consistent with 2024 results, remaining at around 3 percent of the fleet, according to the report.

Ninety percent of respondents said they plan to fly more in 2025. As travel continues to reach pre-pandemic levels, experts predict that overall, large jets are expected to account for about two-thirds of all expenditures of new business jets in the next five years, consistent with last year's results.

Meanwhile, 82 percent of respondents considered “performance" among their top three most important criteria when purchasing their next aircraft, followed by cost at 60 percent, the report said.

By Staff

Tuesday, October 22, 2024 12:15 PM

Generative AI is transforming the software development lifecycle (SDLC), according to a

new report from MIT Technology Review Insights, a division of MIT Technology Review that conducts research and analysis to create content about technology. The report finds that more business leaders are using AI to help assist in the creation of new software.

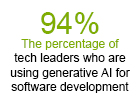

New data shows that 94 percent of leaders use generative AI for software development, but despite this, only 12 percent of respondents said that generative AI has “fundamentally” changed how they develop software.

Generative AI is used in several key areas of software development, including design and prototyping at 65 percent, code generation at 61 percent, and ideation and requirement development at 59 percent.

The report noted that future gains in the use of AI in developing software are widely anticipated, with 38 percent of respondents believing generative AI will “substantially” change the SDLC across most organizations in one to three years.

The response to generative AI in the development of software has been mostly positive, with 46 percent of respondents reporting generative AI is already meeting expectations. Meanwhile, 49 percent of tech leaders said they believe advanced AI tools, such as assistants and agents, will lead to efficiency gains or cost savings, according to the report.

By Staff

Monday, October 21, 2024 2:04 PM

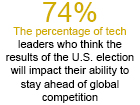

Business leaders are concerned about the impact the U.S. election will have on their ability to stay ahead of global competitors, according to a

new report from Ernst & Young LLP. The survey finds that 74 percent of tech leaders think the results of the election will have an effect on their ability to stay competitive in the next two to four years.

Specific focus areas of AI investment include hiring AI-specific talent, back-office functions and cybersecurity. As companies look to further develop AI initiatives, there will be a growing need to hire AI-specific talent, while also restructuring and/or reducing legacy job functions in exchange for other in-demand functions.

New data shows that 82 percent of companies plan to increase their investment in AI by 50 percent or more in the next year.

Tech leaders said around 63 percent of their organization's AI initiatives have successfully moved to the implementation phase. However, organizations that employ more employees report less success in moving AI initiatives to the implementation phase.

More than 80 percent of tech leaders surveyed said they foresee reducing or restructuring head count from legacy functions to other in-demand functions, and 77 percent anticipate an increase in hiring for AI-specific talent.

Additionally, 40 percent of technology leaders say their company plans to focus next year's AI investments on human capital efforts, such as training.

By Staff

Friday, October 18, 2024 7:19 PM

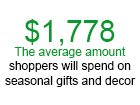

Economic uncertainty has not put a damper on the holiday shopping season. A newly released

2024 Deloitte holiday retail survey finds that consumers are planning to spend an average of $1,778 this season, up 8 percent compared with 2023.

Experts say the increased spending is being driven by an improved economic outlook and has created a shift in how consumers are spending their money this year. Spending on items such as experiences is up 16 percent this year, compared with 2023, and spending on non-gifts, decor and party accessories is up 9 percent.

Seven in 10 respondents said they had made plans to cut spending on self-gifting and are expecting to shop at least one promotional event.

Shoppers are also looking for a bargain, with 62 percent reporting they will shift brands if a preferred brand is too expensive, and 48 percent say they will be shopping at more affordable retailers.

Multichannel shopping continues to grow in popularity, especially among younger buyers, with 48 percent of respondents reporting they plan to shop on smartphones, while 13 percent plan to purchase on social media. More specifically, Gen Z is embracing these channels more, according to Deloitte, with 58 percent planning to shop on their smartphone and 20 percent planning to buy gifts on social media.

By Staff

Thursday, October 17, 2024 11:17 AM

Experts are signaling an improved retail performance is on the horizon for this holiday season. A

new report from the National Retail Federation (NRF) predicts that winter holiday spending is expected to grow between 2.5 percent and 3.5 percent above 2023 sales. This reflects a total holiday spending figure of between $979 billion and $989 billion in November and December, compared with $955 billion in 2023.

The NRF predicts that companies will have to hire between 400,000 and 500,000 seasonal workers this year to keep pace with sales growth. This is down slightly from last year, when seasonal hires topped 509,000.

Several factors are contributing to the slightly lower sales figures this year, including a shorter shopping season between Thanksgiving and Christmas. This year, shoppers have five fewer days than in 2023 to get their shopping done.

Additionally, the season is expected to feel the economic impacts of Hurricane Helene and Milton. The NRF noted that despite the 2024 U.S. presidential election occurring during the holiday season, they cannot predict how it will affect future spending.

By Staff

Wednesday, October 16, 2024 3:42 PM

Despite more consumers demanding sustainable travel, few are taking action to participate, according to a recent report. The latest

Sustainable Travel Consumer Report 2024 from Trip.com Group finds that there is a significant gap between awareness and action when it comes to sustainable travel. New data shows that 92 percent of travelers may consider sustainable travel, but only 57 percent have practiced it.

Experts believe the primary barriers to participation include a perception of sustainable travel as a collective endeavor or that it does not bring added benefits when traveling.

Experts said the report reflects travelers' unwillingness to add to their travel costs. Presently, 32 percent of travelers opt out of paying any additional costs when traveling. More than 75 percent said they expect to see clearly labeled sustainable options when booking with travel providers, and 53 percent said they prefer to see sustainable travel tips online.

Sustainable travel has taken on different attitudes based on generational preferences, with Gen Z most likely to report that they understand it is a shared responsibility. More than 73 percent of Gen Zers said they would consider buying from companies offering sustainable options. Additionally, 53 percent said the environment was a key motivating factor for traveling sustainably, however, 48 percent said they weren’t sure what qualifies as a sustainable trip.

By Staff

Tuesday, October 15, 2024 11:08 AM

Retail sales fell slightly month-over-month in September, according to the latest

CNBC/NRF Retail Monitor released by Affinity Solutions and the National Retail Federation. “After seven consecutive months of gains, consumers pulled back a bit in September, which is historically a soft month for retail sales,” said Matthew Shay, NRF president and CEO.

Total retail sales in September, excluding automobiles and gasoline, were down 0.32 percent seasonally, adjusted month-over-month, but were up 0.55 percent unadjusted year-over-year in September, according to the Retail Monitor. This was a 0.45 percent month-over-month increase compared to August and a 2.1 percent year-over-year bump compared with the same time in 2023.

Many factors influenced the drop in September, including global tensions and slow economic recovery.

September sales were up in five out of nine retail categories, led by online sales, clothing, and accessories stores, and health and personal care stores.

By Staff

Monday, October 14, 2024 2:21 PM

Wildlife populations continue to decline, as habitats are lost to climate change and industrialization, according to the

Living Planet Report released by the World Wildlife Fund International (WWF). The report shows that in the past 50 years, there has been a 73 percent decline in the average size of monitored wildlife populations.

While the numbers have been less dramatic in North America, where the average decline has been 39 percent, the WWF said this still reflects the fact that large-scale impacts on nature were already apparent before 1970 in these regions.

The organization noted that declines in wildlife populations can act as an early warning indicator of increasing extinction risk and the potential loss of healthy ecosystems. When ecosystems are damaged, the WWF noted, they cease to provide humanity with the benefits we have come to depend on, such as clean air, water and healthy soils. They also can become more vulnerable to tipping points resulting in substantial and potentially irreversible change.

The organization noted that nature-based solutions can help reduce the impact by harnessing the power of nature to boost natural ecosystems, biodiversity and human well-being to address major societal issues, including climate change. For example, the WWF suggested that the restoration of forests, wetlands and mangroves can boost carbon storage, enhance water and air quality, improve food and water security, and help protect against erosion and flooding.

By Staff

Friday, October 11, 2024 4:22 PM

The recent East Coast port strike has not slowed down the nation’s imports. The latest

Global Port Tracker, from the National Retail Federation and Hackett Associates, shows that imports will be elevated in October, despite the three-day shutdown.

Earlier this month, members of the International Longshoremen’s Association went on strike at East and Gulf Coast container ports after their contract with the U.S. Maritime Alliance expired. The strike lasted just three days, and a short-term contract extension and wage increase were implemented until January 15, 2025.

U.S. ports covered by Global Port Tracker handled 2.34 million twenty-foot equivalent units (TEUs) in August, excluding the Ports of New York/New Jersey and Miami, which have yet to report final data. This data reflects an increase of 0.9 percent compared with July and 19.3 percent year over year. It is also the highest volume reported since May 2022.

November TEUs are expected to fall to 1.91 million, up 0.9 percent year over year, and December is expected to drop slightly to 1.88 million TEU, up 0.2 percent year over year.

According to the Global Port Tracker, this would bring 2024 to 24.9 million TEU, up 12.1 percent compared with 2023. Meanwhile, January 2025 is forecast to steadily climb to 1.98 million TEU, up 0.8 percent year over year. February 2025 is forecast to slip to 1.74 million TEU, down 11.2 percent because of fluctuations in the timing of Lunar New Year shutdowns at Asian factories.

By Staff

Thursday, October 10, 2024 5:04 PM

More law firms are relying on artificial intelligence (AI) to improve efficiency, according to a

new report from Clio, a provider of cloud-based technology for the legal industry. The ninth edition Clio’s Legal Trends Report explores how AI adoption is shaping the direction of the legal industry.

New data shows that 79 percent of legal professionals now incorporate AI tools into their daily work, compared with 19 percent in 2023. Clients are also on board with this shift, with 70 percent reporting they either prefer its use or are neutral toward firms that utilize AI.

This adoption also affects how law firms bill for their time. Data shows that up to 74 percent of hourly billable tasks, such as information gathering and data analysis, could be automated with AI. Something, Newton noted, should be prompting law firms to move away from hourly billing in favor of more flexible options like flat fees to preserve profitability while benefiting from the increased efficiencies AI brings to legal workflows.

The survey found that 81 percent of legal secretaries and administrative assistants' tasks could be made automatable, compared with 57 percent of lawyers' tasks.

As a result, 34 percent of law firms are charging a flat fee for most of their cases, something 71 percent of clients are in favor of for their entire case. Meanwhile, 51 percent of respondents said they prefer a flat fee for individual activities performed by legal guidance.

By Staff

Wednesday, October 9, 2024 2:43 PM

The unemployment rate showed little change in September, holding steady at 4.1 percent, according to the

latest data from the U.S. Bureau of Labor Statistics (BLS). Employment increased by 254,000 new jobs in September with the biggest growth seen in food services and drinking establishments, health care, government, social assistance and construction sectors.

The number of unemployed people also held steady in September, remaining mostly unchanged at 6.8 million people. In a statement, the BLS noted that these measures are higher than a year earlier, when the jobless rate was 3.8 percent, and the number of unemployed people was 6.3 million.

For the third consecutive month, the labor force participation rate was 62.7 percent and the employment-population ratio remained at approximately 60 percent.

The number of people employed part-time for economic reasons increased to 4.6 million in September compared with 4.1 million a year earlier. According to BLS, these individuals would have preferred full-time employment but were working part-time because their hours had been reduced, or they could not find full-time jobs.

The number of people not in the labor force who currently want a job also remained relatively unchanged at 5.7 million. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

The number of people not in the labor force who wanted a job increased by 204,000 to 1.6 million.

By Staff

Tuesday, October 8, 2024 1:50 PM

Government agencies are struggling to keep pace with generative AI adoption. A new global study,

Your Journey to a GenAI Future: A Strategic Path to Success for Government conducted by SAS, an analytics platform, and Coleman Parkes Research, finds that government agencies are lagging behind other sectors when it comes to the adoption of generative AI.

Despite this fact, 60 percent of government respondents believe generative AI will drive innovation, and those who have begun using it are already seeing improvements in employee satisfaction, compliance, operational costs and time efficiencies.

The survey found that 84 percent of government decision-makers plan to invest in generative AI within their organizations during the next fiscal year. Meanwhile, 91 percent of respondents said they are already dedicating a portion of their operating budget to generative AI.

The study also showed there is a lack of generative AI awareness among public sector employees. Just 35 percent are familiar with their organizations' adoption of generative AI, compared with the 46 percent overall average.

Decision-makers are still driven to generative AI into their overall business structure, with 94 percent of respondents saying they have seen an improvement in employee experience and satisfaction, and 84 percent reported that the technology has created operational, financial and time efficiencies.

By Staff

Monday, October 7, 2024 3:00 PM

With fall conference season well underway, Cheap Hotels has released its list of the most expensive cities for hotel stays in the U.S. Boston tops the list as the most expensive city for accommodation, where the average price for a double room has reached $320. Hotels in the survey were chosen based on their central location and 3-star rating or higher.

Jersey City comes in at second place with rates averaging $310, followed by New York City at $284. Raleigh jumped to fourth place, averaging $258 per night, an increase of more than 25 percent compared with 2023.

Skyrocketing hotel prices are not just confined to major urban centers. In comparison, earlier this year, Cheap Hotels released the

names of cities that offered the most expensive hotel stays during the summer travel months in the Midwest. In this case, Ann Arbor topped the list for the Midwestern region, averaging $287 per night for the least expensive room. Saint Joseph and South Haven were second and third at $274 and $256 respectively.

By Staff

Friday, October 4, 2024 3:37 PM

U.S. retailers are bracing for strong Black Friday to Cyber Monday (BFCM) sales outlook. A

new report from Bain & Company, predicts sales will top $75 billion during the popular holiday shopping weekend, up more than 5 percent year over year, outpacing overall holiday sales growth. It’s expected that 8 percent of holiday sales will occur between Black Friday and Cyber Monday in 2024, the highest share since 2019.

The firm is forecasting that retail momentum will continue to be strong throughout the weekends leading up to Christmas, with a peak shopping day on December 21, the Saturday before Christmas, and December 23, the Monday before Christmas.

Experts at Bain & Company believed these late-in-season shopping surges are expected to give an additional push to retailers and will deliver strong results in overall holiday shopping numbers this season.

The company added that Cyber Monday has seen its relevance fade, falling out of the top sales days after 2019. Additionally, e-commerce growth has slowed, and many shoppers feel that they can conveniently shop online anytime, with deals extending beyond the core weekend.

By Staff

Thursday, October 3, 2024 1:41 PM

Despite better education and access to care, the majority of U.S. adults still demonstrate high levels of addiction stigma. A new report from Shatterproof, titled

Shatterproof Addiction Stigma Index, shows that 74 percent of Americans don't believe a person with a substance use disorder (SUD) is experiencing a chronic medical illness.

There are nearly 49 million people in the U.S. aged 12 years and older who are living with SUDs. Meanwhile, less than 5 percent of people who need addiction treatment will ever receive it, making this the nation's most urgent public health issue, according to experts.

The survey found that the stigma associated with SUDs has created barriers to care and acceptance, with 45 percent of respondents reporting they are unwilling to move next door to a person with SUD.

Additionally, 47 percent of respondents said they are unwilling to have a person with SUD as a close friend. Meanwhile, 43 percent of respondents said that they believe that medications for opioid use disorder (MOUD) are simply substituting one drug addiction for another.

The study did find that some attitudes are changing towards SUDs. Nearly three in four respondents said they agree that fentanyl testing strips should be free and available as a key tool in preventing drug-related fatalities.

The majority of respondents also felt that more health care providers should offer MOUD, a treatment for opioid use disorder so that they are easily accessible. They also believe that MOUD is an effective treatment for opioid use disorder (OUD). A similar number of respondents felt that treatment strategies are more effective than prison sentences for drug-related, non-violent crimes.